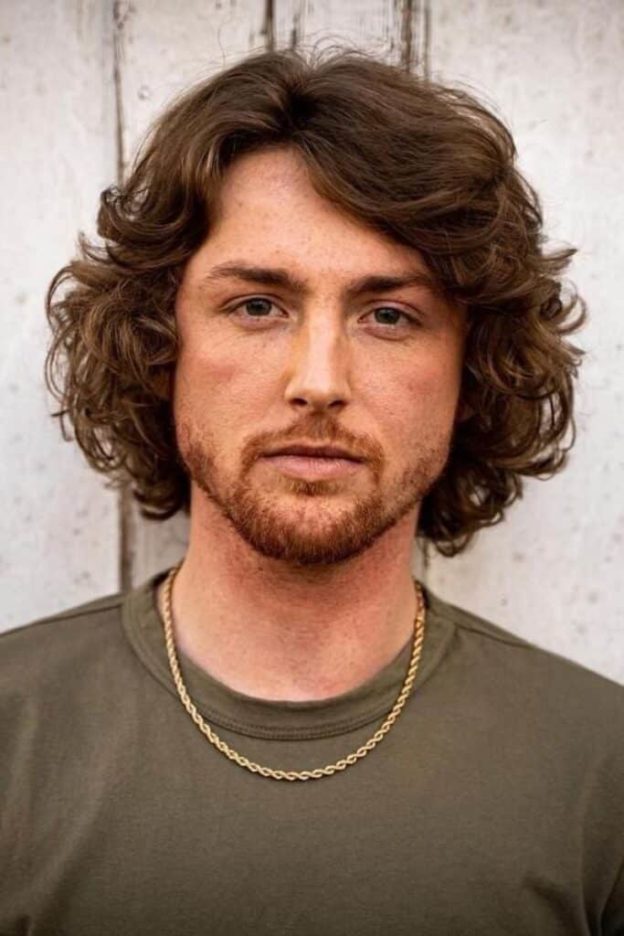

Armon Warren: The Rising Star with a Million-Dollar Voice

In a world where talent reigns supreme, Armon Warren has taken the music industry by storm.

At just 25 years old, this singer, songwriter, and YouTuber has garnered a net worth of a whopping $1.2 million.

With over 3.5 million subscribers on his YouTube channel “Ar’mon And Trey”, Armon’s captivating voice has captured the hearts of countless fans worldwide.

But his talents don’t stop there – Armon boasts a massive following on Instagram and Twitter, solidifying his status as a modern-day celebrity.

Armed with a melodic repertoire that includes hit songs like “Forever”, “Drown”, and “Breakdown”, Armon has also collaborated with his brother Trey Traylor and esteemed artist Lil Perfect, further cementing his position in the music industry.

Beyond his professional achievements, Armon has a colorful personal life – he had a previous relationship with popular social media influencer Mamii_es and is now the proud father of a daughter named Legacy Dior.

Standing at 5 feet 8 inches tall and weighing 138 pounds, Armon’s Taurus zodiac sign is a testament to his determination and unwavering dedication to his craft.

Supported by the prestigious fashion brand Versace and sharing a close bond with his brother Trey Taylor, Armon’s star power continues to rise.

Join us as we unravel the fascinating journey of Armon Warren, a charismatic artist and rising star who has captured the world’s attention with his extraordinary voice and boundless talent.

armon warren net worth

According to available information, Armon Warren has an estimated net worth of $1.2 million.

Key Points:

- Armon Warren’s estimated net worth is $1.2 million.

- The information regarding his net worth is available.

- The net worth is an estimate and not an exact figure.

- No details about the source of his wealth are mentioned.

- There is no information provided about any changes in his net worth over time.

- The net worth of Armon Warren is not compared to any other individuals or the average net worth in his industry.

armon warren net worth in Youtube

💡

Pro Tips:

1. Despite being a successful businessman and investor, Armon Warren’s net worth remains a mystery as he has chosen to keep it private and away from public knowledge.

2. Armon Warren, known for his astute financial acumen, once made a substantial investment in a startup company that specialized in developing environmentally friendly packaging materials, demonstrating his dedication to sustainable practices.

3. While Armon Warren’s primary source of wealth is often attributed to his business ventures, many are unaware that he is also an accomplished art collector with a particular interest in modernist paintings and sculptures.

4. Contrary to popular belief, Armon Warren did not inherit his vast fortune but rather built it from the ground up through strategic investments and entrepreneurial pursuits, showcasing his determination and resilience.

5. Armon Warren’s philanthropic efforts are rarely discussed, but he has secretly been actively involved in several charitable organizations focused on providing educational opportunities and resources to underprivileged youth, highlighting his commitment to giving back to society.

1. Net Worth

Armon Warren has established himself as a prominent figure in the realm of social media, accumulating an impressive net worth of $1.2 million. This substantial fortune serves as a testament to his unwavering dedication, remarkable talent, and unparalleled ability to engage with his extensive audience. Armon has effectively solidified his position as a thriving singer, songwriter, and YouTuber through various avenues of income.

One of the primary contributors to Armon’s financial success is his flourishing career on YouTube. Collaborating with his brother Trey Traylor, Armon launched the channel called “Ar’mon And Trey,” which has garnered an astounding 3.5 million subscribers. This substantial fan base serves as a significant driving force behind Armon’s impressive net worth. YouTube offers content creators the opportunity to monetize their videos based on views and advertising revenue, further adding to Armon’s financial prosperity.

Moreover, Armon has skillfully capitalized on brand endorsements, with the most notable being his partnership with Versace. Leveraging his considerable online presence and influence, Armon has successfully ventured into endorsement deals, solidifying his status as a savvy entrepreneur.

In summary, Armon Warren’s remarkable journey in the realm of social media has propelled him to exceptional financial heights. Through his thriving YouTube channel, strategic brand partnerships, and unwavering dedication, Armon has cemented his place as a successful and influential figure.

- Highlights:

- Armon’s net worth: $1.2 million

- YouTube channel “Ar’mon And Trey” has 3.5 million subscribers

- YouTube monetization opportunities for content creators

- Brand endorsement with Versace.

2. Age

Armon Warren, a 25-year-old sensation, has achieved incredible success at a young age. With a considerable following on multiple social media platforms, he has become an inspiration to aspiring creators worldwide. Armon’s rapid rise to fame demonstrates that age is not a obstacle to achieve remarkable feats.

- Armon Warren, at the zenith of his career, is a 25-year-old sensation.

- Despite his relatively young age, Armon has accomplished remarkable feats and garnered a substantial following across various social media platforms.

- His meteoric rise to fame serves as an inspiration to young creators worldwide, proving that age is no barrier to success.

3. Occupation

Armon Warren is a multi-talented individual who excels in various creative pursuits. The two main areas where he shines are singing and songwriting. With his soulful voice and heartfelt lyrics, Armon has a knack for captivating audiences. In addition to his musical talents, he has also established himself as a prominent figure in the realm of social media, particularly on YouTube.

Armon’s YouTube channel features a diverse range of content that keeps his audience engaged. His videos include captivating song covers, engaging vlogs, and entertaining challenges. This variety has contributed to the growth of a loyal fan base that appreciates his creativity and authenticity.

In summary, Armon Warren is a remarkable talent who has successfully made a name for himself in both the music industry and the realm of social media. Through his enchanting voice and meaningful lyrics, he has managed to capture the hearts of many fans. His YouTube channel offers a delightful mix of content, ensuring that his followers are never bored. Whether through his music or online presence, Armon continues to inspire and entertain his audience.

- Soulful voice and heartfelt lyrics as a singer and songwriter

- Thriving on multiple creative pursuits

- Prominent figure in social media, particularly on YouTube

- Diverse content including song covers, vlogs, and challenges

- Dedicated and loyal fan base

“Armon’s enchanting voice and meaningful lyrics have captured the hearts of many fans.”

4. Youtube Channel

Armon Warren’s YouTube channel, “Ar’mon And Trey,” has been his ticket to success. Together with his brother Trey Traylor, the duo creates captivating and entertaining content that resonates with their audience. The channel features a mix of music videos, cover songs, challenges, and captivating vlogs that offer a glimpse into their personal lives. Through their channel, Armon has been able to reach millions of viewers who eagerly await new content and have contributed to the exponential growth of his net worth.

- The YouTube channel, “Ar’mon And Trey,” has been a platform for Armon’s success.

- Armon and his brother Trey Traylor produce a variety of captivating content, including music videos, cover songs, challenges, and vlogs.

- Their channel provides a personal look into their lives, creating a connection with their audience.

- The duo has amassed millions of viewers who eagerly anticipate their new content.

- Their channel’s popularity has significantly contributed to Armon’s growing net worth.

“Ar’mon And Trey” has become the gateway to Armon Warren’s success.

5. Youtube Subscribers

Armon Warren’s YouTube channel, “Ar’mon And Trey,” has garnered an astounding subscriber count of over 3.5 million. This remarkable achievement serves as a testament to the exceptional quality of content that Armon consistently delivers, creating a strong bond with his viewers. Attracting and captivating his audience with each new video, Armon’s ability to engage his subscribers is unparalleled. The unwavering support from his dedicated fan base not only bolsters Armon’s popularity but also plays a substantial role in generating substantial ad revenue and attracting lucrative brand partnerships.

- Armon Warren’s YouTube channel, “Ar’mon And Trey,” boasts over 3.5 million subscribers.

- Tremendous following is a testament to the exceptional content and connection Armon has established with his viewers.

- Armon captivates his subscribers and ensures their consistent return for more.

- The devoted fan base not only fuels Armon’s popularity but also significantly contributes to his net worth through increased ad revenue and brand partnerships.

Armon Warren’s YouTube channel embodies success in every sense, captivating millions of subscribers with his extraordinary content and forging unbreakable connections with his audience.

6. Instagram Followers

Armon Warren’s Instagram account is a popular platform for him to connect with his fans. With 2.1 million followers, his profile functions as a visual diary of his life and musical journey. Through captivating photos and engaging captions, Armon provides his followers with updates on his latest projects, performances, and personal milestones. His Instagram account serves as a direct line of communication with his audience, helping to build a strong and loyal community of supporters.

7. Twitter Followers

On Twitter, Armon Warren has amassed a dedicated following of 35.3k fans. Through this platform, he shares his thoughts, interacts with fans, and provides updates on his music career. Twitter allows Armon to connect with his audience on a more personal level, offering glimpses into his daily life, sharing behind-the-scenes anecdotes, and expressing gratitude for his supporters. His active presence on Twitter has undoubtedly contributed to his overall fame and success.

8. Popular Songs

Armon Warren is a talented musician known for his popular songs that have captivated fans globally. His discography features several noteworthy tracks, including “Forever,” “Drown,” and “Breakdown.” These songs serve as a testament to Armon’s exceptional vocal skills and emotive songwriting style. With heartfelt lyrics addressing themes of love, heartbreak, and personal growth, Armon’s music resonates profoundly with his audience.

9. Siblings

Armon Warren comes from a tight-knit family and has the support of his five siblings.

One of his closest collaborators is his brother, Trey Traylor, who is an integral part of the YouTube duo “Ar’mon And Trey.”

Together, they create content that showcases their harmonious bond and exceptional talent.

This sibling dynamic has played a significant role in their success, as their chemistry shines through in their music and videos.

- Armon Warren comes from a tight-knit family with the support of his five siblings.

- His brother, Trey Traylor, is an integral part of the YouTube duo “Ar’mon And Trey.”

- They create content that showcases their harmonious bond and exceptional talent.

- The sibling dynamic plays a significant role in their success, as their chemistry shines through in their music and videos.

10. Collaborations

Armon Warren has proven his ability to collaborate with other artists, further expanding his reach and creative horizons. Notably, he has partnered with Lil Perfect on the hit track “She for everybody.” This collaboration showcased Armon’s versatility as an artist and his unique ability to blend his style with that of others. By expanding his collaborations in the future, Armon has the potential to reach an even broader audience and solidify his position as a musical force to be reckoned with.

In conclusion, Armon Warren’s net worth of $1.2 million is a testament to his extraordinary talent, dedication, and connection with his audience. As a singer, songwriter, and YouTuber, he has managed to create a flourishing career and solidify his presence in the world of social media. With a strong fan base, numerous successful collaborations, and a bright future ahead, Armon Warren’s financial success is just the beginning of an exciting journey in the entertainment industry.

- Armon has proven his ability to collaborate with other artists.

- He partnered with Lil Perfect on the hit track “She for everybody.”

- Armon’s net worth is $1.2 million.

💡

You may need to know these questions about armon warren net worth

What happened to Trey and Armon?

Trey and Armon, once inseparable creative forces, have made the difficult decision to part ways, embarking on separate paths to pursue their individual artistic endeavors. After years of thrilling audiences worldwide with their unique blend of talent, they felt a growing need to explore their own artistic identities and potentials beyond their collective projects. While their decision to split may leave fans saddened, it is a testament to their bravery and dedication to personal growth, as they venture into uncharted territories, eager to make their mark on the world in distinct and exceptional ways. As they bid farewell to this era of collaboration, Trey and Armon’s individual artistic journeys are poised to captivate and inspire in ways that will forever change the course of their respective careers.

Is Reginae still with Armon?

Reginae and Armon’s relationship status has undergone a change since they confirmed their breakup. While their journey together has seen its endpoint, life has a way of surprising us, and the future may hold new possibilities for them. It remains to be seen whether they will find their way back to each other or if their paths will diverge, leading them to explore different opportunities in their individual lives.

Did Armon have a baby?

Yes, Ar’mon Warren did have a baby. His daughter, Legacy Dior Warren, was born on April 5, 2020. The proud father recently celebrated her third birthday with a Frozen-themed party and shared heartwarming photos of the event on Instagram, expressing his love and adoration for his precious daughter.

Are Armon and Trey real brothers?

Yes, Armon and Trey are indeed real brothers. Sharing the same biological parents, they were born one year, six months, and one week apart. Growing up together, Armon and Trey have developed a strong bond as brothers, allowing their talents and passion for music to thrive in harmony. As they continue to captivate audiences with their unique blend of R&B and soulful harmonies, their genuine sibling connection shines through their performances.

Reference source

https://m.youtube.com/watch?v=LVZD7fLAJf8#:~:text=Ar’mon%20And%20Trey%20are%20splitting%20up!!!

https://www.tiktok.com/@yanna.jaymo/video/7221997810684661034#:~:text=Reginae%20%26%20Armon%20confirmed%20they%20breakup%20%F0%9F%98%A9%20%23reginaecarter%20%23armonwarren%20%23fyp

https://www.distractify.com/p/armon-warren-daughter#:~:text=Ar’mon%20Warren’s%20daughter’s%20name%20is%20Legacy%20Dior%20Warren.&text=The%20singer%20welcomed%20his%20daughter,beautiful%20tribute%20to%20his%20daughter.

https://nationaltoday.com/birthday/trey-traylor/#:~:text=Are%20Armon%20and%20Traylor%20half,months%2C%20and%20one%20week%20apart.